Author: Bitget

Today's Outlook

1. PANews News, Bloomberg: The median stock price of US and Canada listed DAT companies has fallen 43% this year.

2. Michael Saylor has once again released Bitcoin Tracker information, with data on increased holdings potentially being disclosed this week.

3. Data: Total supply of USDT exceeds 190 billion, hitting a new record high.

Macro & Hot Topics

1. K33 Research Analyst Vetle Lunde: December could be a turning point for the crypto market in the near term, with structural upside potential forming. Bitcoin's current valuation reflects market panic sentiment more than fundamental factors. The likelihood of a significant market rise is far greater than an 80% decline again, making December a potential bold opportunity for building positions.

2. Trump: "In the near future, there will be no need to pay personal income tax." It is reported that Trump plans to replace the current personal income tax system with tariff revenue.

3. Hassett: Unless there is a "black swan" disruption, the US is set to welcome a golden year in economic history.

Market Trends

1. Over the past 24 hours, the cryptocurrency market saw a total of $439 million in liquidations, with long positions accounting for $295 million. BTC liquidation amounted to $109 million, while ETH liquidation reached $181 million.

2. US Stocks: Dow Jones fell 0.22%, S&P 500 rose 0.19%, and Nasdaq Composite increased by 0.31%.

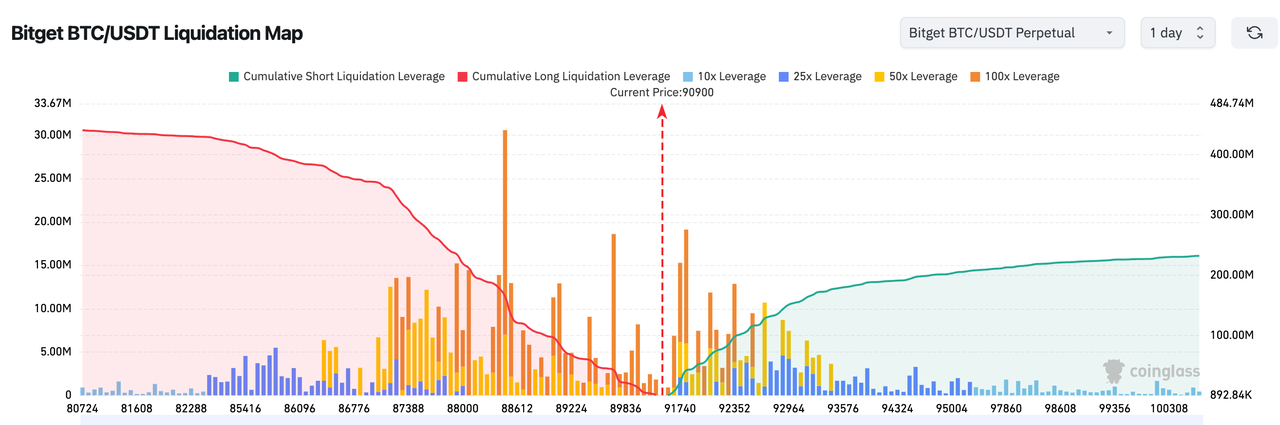

3. Bitget BTC/USDT Liquidation Map shows: There is a dense long liquidation zone around $90,900 for BTC. If this range is broken, it may trigger further cascading long liquidations. Above, significant short positions are concentrated in the $92,000–$95,000 range. If the price probes this area, accelerated upward movement due to short squeezes may occur.

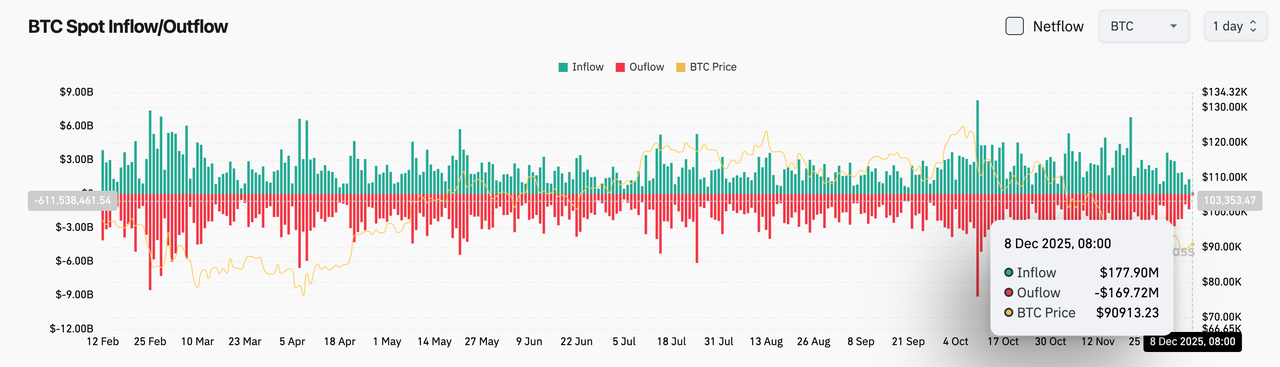

4. Over the past 24 hours, BTC spot inflows were $177 million, outflows were $169 million, resulting in a net inflow of $8 million.

News Updates

1. Global asset management firm WisdomTree launches a new tokenized fund, bringing options yield strategies to the blockchain.

2. Analysis: The US SEC plans to evaluate the regulatory weight on crypto privacy, potentially leading to polarized disagreements.

3. Musk: Grok 4.20 will be released within 3 to 4 weeks.

Project Developments

1. Farcaster Co-founder Dan Romero: Farcaster is focused on building a wallet to attract more users.

2. HumidiFi: The new token public sale will begin on December 8 at 23:00.

3. Ethena withdraws another 25 million ENA from Bybit, worth $7.05 million. This wallet currently holds 779.89 million ENA, with a total value of $207.7 million.

4. ZKsync plans to deprecate the early network ZKsync Lite in 2026.

5. Tokens like APT, LINEA, and CHEEL are set for significant unlocks this week, with APT unlocks valued at approximately $19.3 million.

6. A wallet suspected to belong to Wintermute has accumulated about $5.2 million in SYRUP tokens over the past two weeks.

7. Solana Foundation President calls for lending protocols to stop internal conflicts and focus on growing the market.

8. Twenty One Capital is set to list on the New York Stock Exchange on December 9.

9. Analyst: CEX platform ETH holdings have dropped to a historic low of 8.8%, with tight supply potentially driving price increases.

10. Nvidia CEO Jensen Huang: Bitcoin is absorbing excess energy and storing it as a new form of currency.

Disclaimer: This report is generated, with human verification for information only, and does not constitute any investment advice.